- Manish Jain

View

Share

In the financial landscape of 2026, digital banking is no longer a differentiator—it is the baseline. Mobile apps, AI-powered chat, and self-service portals now handle the majority of transactional activity. Yet as banking becomes more automated, customer expectations around human support have risen sharply.

When financial situations become complex, emotional, or high-risk, customers do not want automation—they want reassurance, expertise, and accountability. In this environment, banking customer service outsourcing has evolved from a cost-management tactic into a strategic driver of trust, loyalty, and competitive advantage.

This anchor guide explores how nearshore, relationship-first outsourcing models enable banks and financial institutions to deliver high-touch support at scale—without sacrificing compliance or control.

The Evolution of Banking Customer Service in a Digital-First Era

Digital-first banking has redefined how customers interact with financial institutions:

- Routine transactions are completed independently

- Support interactions are fewer—but far more critical

- Every live interaction carries higher emotional and financial stakes

As a result, customer service is no longer about handling volume. It is about handling moments that matter.

These moments include fraud alerts, disputed transactions, loan decisions, payment failures, and account access issues. How banks respond during these interactions directly determines customer retention and brand perception.

Why Banking Customer Service Outsourcing Matters More in 2026

Several converging forces have elevated the importance of banking customer service outsourcing:

- Rising Customer Expectations. Customers expect 24/7 availability, immediate resolution, and empathetic communication—especially during stressful financial events.

- Increased Regulatory Complexity. Agents must navigate KYC, AML, FDCPA, PCI DSS v4.0, and evolving privacy mandates without error.

- Talent Shortages. Domestic hiring struggles to keep pace with demand for finance-trained, compliance-aware customer service professionals.

Strategic banking customer service outsourcing addresses all three pressures simultaneously.

The Human Element: Where Automation Stops

Automation excels at speed and scale—but fails at judgment, nuance, and empathy.

When a customer receives a fraud alert at 2:00 AM or faces uncertainty around a mortgage application, scripted responses erode trust. Human agents trained in a financial context and emotional intelligence are essential.

SkyCom’s banking customer service outsourcing model prioritizes human-led resolution, supported—not replaced—by AI.

High-Stakes Banking Interactions That Demand Expertise

SkyCom’s BFSI-specialized teams manage the most sensitive customer interactions, including:

Fraud & Security Response

- Real-time outreach following fraud alerts

- Account security verification and next-step guidance

- Customer reassurance during high-stress situations

Complex Account & Product Support

- Multi-product account structures

- Transaction disputes and reconciliation

- Escalations requiring critical thinking

Loan, Credit & Mortgage Support

- Application guidance and documentation clarity

- Servicing inquiries and payment issues

- Regulatory-compliant customer communication

These interactions shape long-term customer trust.

The Relationship-First Nearshore Delivery Model

Not all outsourcing models are created equal. Far-shore delivery often introduces language gaps, cultural friction, and delayed escalation—especially harmful in banking.

SkyCom’s nearshore banking customer service outsourcing model across Colombia, El Salvador, and Guatemala is designed for relationship continuity and speed.

Cultural & Linguistic Alignment

- Native English and Spanish proficiency

- Familiarity with North American banking norms

- Natural, unscripted communication styles

Time-Zone Synchronization

- Real-time collaboration during U.S. business hours

- Immediate escalation for fraud or outage events

- Faster resolution cycles during peak demand

Nearshore proximity enables trust-building conversations—not transactional exchange

Knowledge Process Outsourcing (KPO) for Banking CX

In 2026, banking customer service outsourcing has moved decisively toward Knowledge Process Outsourcing (KPO).

SkyCom’s agents are not generalists. They are domain-trained professionals with expertise in:

- KYC and AML frameworks

- FDCPA and consumer protection regulations

- PCI DSS v4.0 compliance

- Secure handling of PII and financial data

This KPO approach ensures that every interaction is accurate, compliant, and defensible.

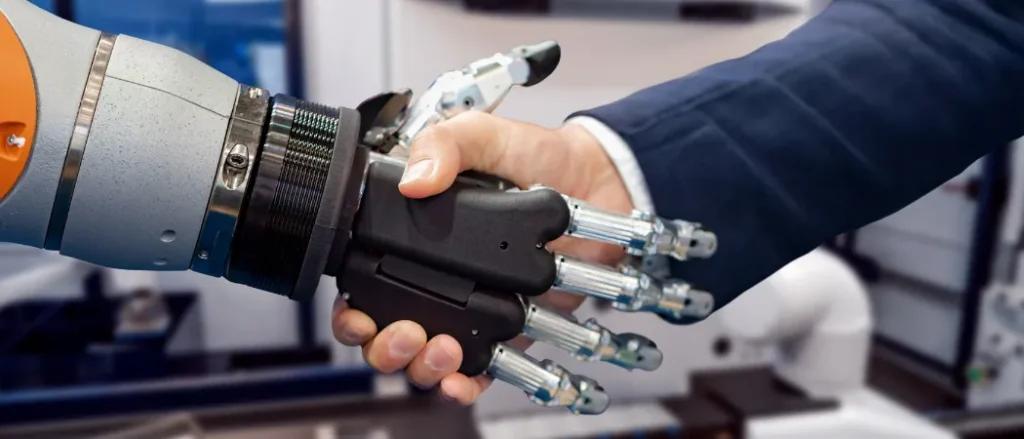

AI as an Enabler—Not a Replacement

SkyCom integrates AI tools to enhance agent effectiveness, including:

- Real-time customer data retrieval

- Intelligent routing and prioritization

- Compliance prompts and QA monitoring

However, final decision-making and customer engagement remain human-led—preserving accountability and empathy.

Nearshore vs Offshore: A Banking CX Comparison

| Dimension | SkyCom Nearshore Model | Offshore Benchmark |

|---|---|---|

| Agent Expertise | BFSI-trained specialists (KPO) | Generalist agents |

| Communication Style | Relationship-first | Script-driven |

| Compliance Readiness | PCI DSS, SOC 1–2, audited | Limited controls |

| Time-Zone Alignment | 0–2 hour difference | 10–12 hour lag |

| Customer Trust Impact | High | Variable |

Compliance, Security, and Governance by Design

Banking customer service outsourcing requires uncompromising security.

SkyCom embeds governance into every layer of service delivery:

- PCI-compliant infrastructure

- SOC 1 and SOC 2 audited processes

- Role-based access and monitoring

- Human-in-the-loop oversight for sensitive actions

This ensures regulatory confidence without slowing customer resolution.

Transforming the Contact Center into a Value Center

Banks that lead in 2026 treat customer service as a strategic asset.

By investing in high-touch, nearshore banking customer service outsourcing, institutions achieve:

- Higher Net Promoter Scores (NPS)

- Reduced churn during critical moments

- Stronger digital trust

- 32%–70% reduction in labor costs through optimized delivery

Service excellence becomes measurable business value.

Ready to Elevate Your Banking Customer Experience?

If your institution is evaluating banking customer service outsourcing to deliver high-touch, compliant, and scalable support, SkyCom is ready to partner.

Speak with SkyCom’s BFSI specialists today to design a nearshore customer service model that turns complex banking moments into long-term brand loyalty.

SEO VARIABLES

Primary Focus Keyphrase: banking customer service outsourcing

Secondary / Supporting Keywords:

- nearshore banking customer service

- BFSI customer support outsourcing

- banking call center services

- financial services contact center

- high-touch banking support

Meta Title (60 chars): Banking Customer Service Outsourcing in 2026

Meta Description (155–160 chars): Learn how banking customer service outsourcing helps digital-first banks deliver high-touch, compliant support that builds trust and loyalty.

URL Slug: banking-customer-service-outsourcing

Search Intent: Informational / Commercial

Target Audience: Banking Executives, CX Leaders, Operations Heads, Digital Banking Strategists